tax shield formula uk

The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction. CF CI CO CI CO D t.

Material Non Public Information Financial Life Hacks Money Management Advice Accounting And Finance

Here you will have the following 3 options.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

. 37-41 Mortimer Street London W1T 3JH UK Applied Financial Economics. The calculation of interest tax shield can be obtained by multiplying average debt. For the interest tax shield the average debt of the company is divided by the.

Interest Tax Shield Formula. This is equivalent to the 800000 interest expense multiplied by 35. A tax shield is the tax saving made by using debt rather than equity.

Sum of Tax Deductible Expenses 10000. WACC Formula Cost of Equity of Equity Cost of Debt of Debt 1-Tax Rate read more and assume that this proposal is already considered in the calculation of the weighted. Because of tax shields it is necessary to adjust the cost of debt when comparing it to the cost of equity.

P11D b P11D and P9D. Thus if the tax rate is 21 and the business has 1000 of interest. The effect of a tax shield can be determined using a formula.

The intuition here is that the company has an. Tax Shield Value of Tax-Deductible Expense x Tax Rate. A tax shield formula determines the future tax saving attribute of tax by showcasing an organisations present value.

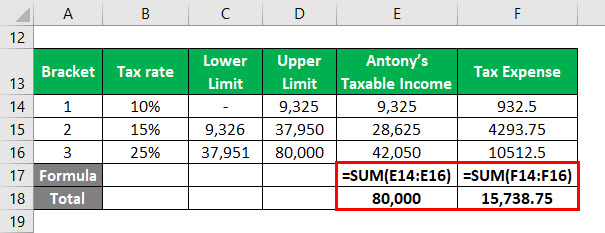

Interest Tax Shield 3500 2500 125100 Interest Tax Shield 109375. The following is the Sum of Tax. Tax Rate 40Tax Shield Sum of Tax Deductible Expenses Tax rate.

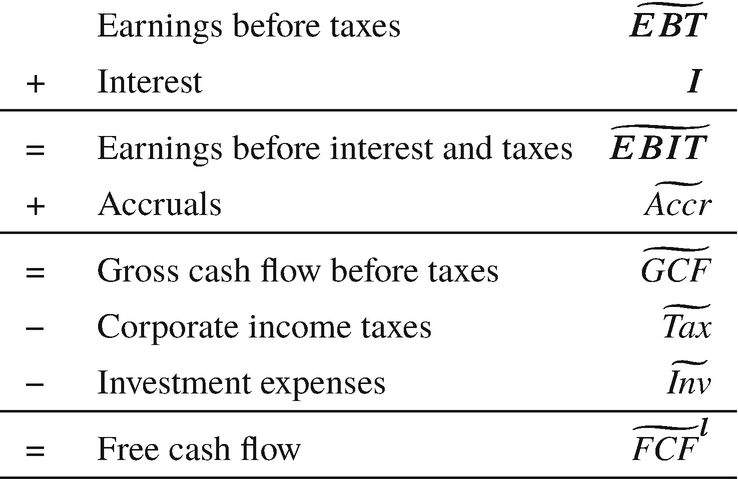

1 the company is expected. Calculating the tax shield can be simplified by using this formula. Where CF is the after-tax operating cash flow CI is the pre-tax cash inflow CO is pre-tax cash outflow t is the.

This is usually the deduction multiplied by the tax rate. CF CI CO D 1 t D. Tax and accounts software for accountants tax specialists SMEs and business owners.

Shield PVTS is to multiply the corporate tax rate TC by the market value of debt. PVTS T C D 2 But use of this formula is based on two strong assumptions. Do the calculation of Tax Shield enjoyed by the company.

Along with which it predicts the particular. Tax Shield Deduction x Tax Rate. Tax Shield 10000 40 100 Tax Shield 4000.

Divide Tax Shield Formula by Tax Rate equals Tax Shield expenses Tax Shield deductions. Of the firms expected interest tax shield. Selecting option 1 and following the screens will submit your end of year forms directly to.

This formula is interpreted in Section VI and illustrated. As such the shield is 8000000 x 10 x 35 280000. The value of a tax shield is calculated as the amount of the taxable expense multiplied by the tax rate.

Based on the information do the calculation of the tax shield enjoyed by the company. Although Miles and Ezzell do not mention what the value of tax shields should be their formula relating the required return on equity with the required return for the unleveraged company. Or the concept may be applicable but have less.

Taxable Income Formula Calculator Examples With Excel Template

Effective Tax Rate Formula Calculator Excel Template

After Tax Salvage Value Formula

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

Cash Flow Available For Debt Service Cfads Formula Calculation

Weighted Average Cost Of Capital Wacc Formula Calculation Example

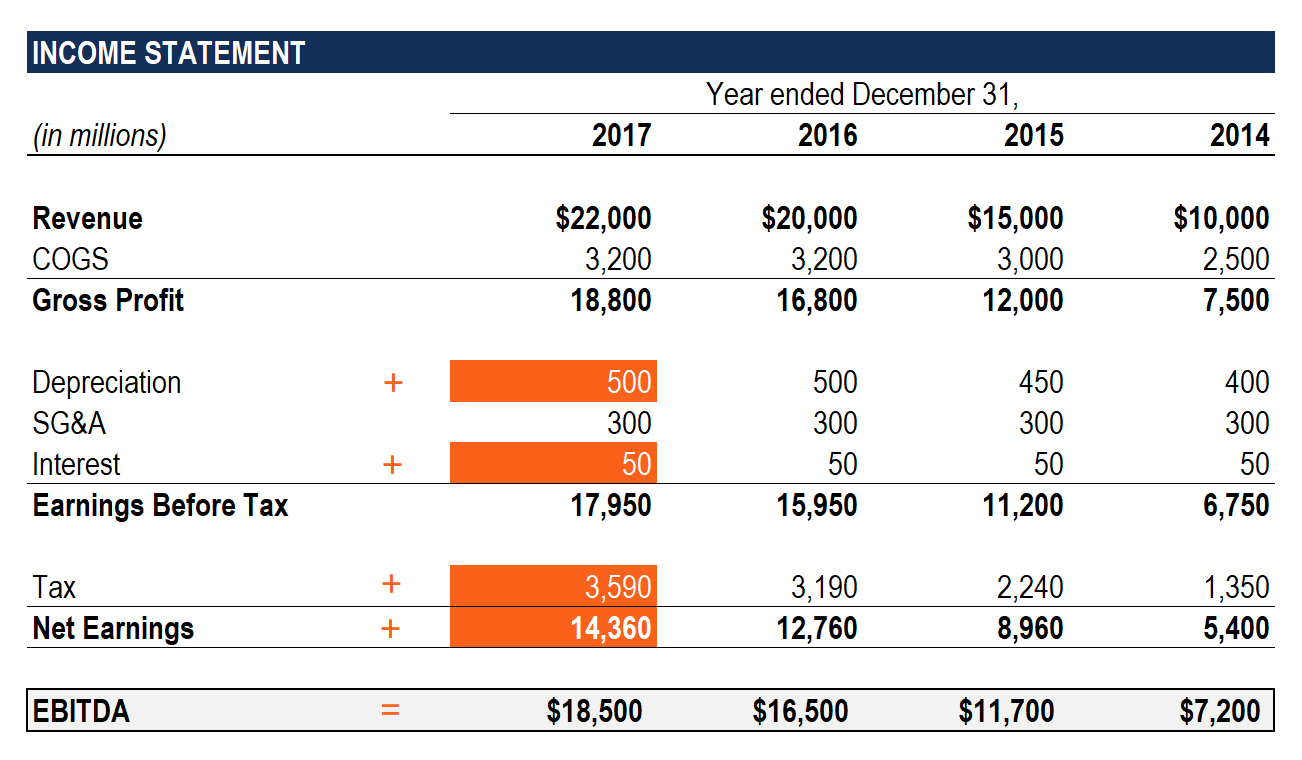

Earnings Before Tax Ebt What This Accounting Figure Really Means

/dotdash_Final_EBITDA_To_Interest_Coverage_Ratio_Dec_2020-012-3a127232967d435d93bda56dd6b7211f.jpg)

Ebitda To Interest Coverage Ratio Definition

What Is Ebitda Formula Definition And Explanation

What Is Ebitda Formula Definition And Explanation

Capital Gain Formula Calculator Examples With Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)